AI Reshapes Data Analytics: Sectoral Dynamics and 2025 Benchmarks

Quick Answer [sectoral acceleration, fact-driven]

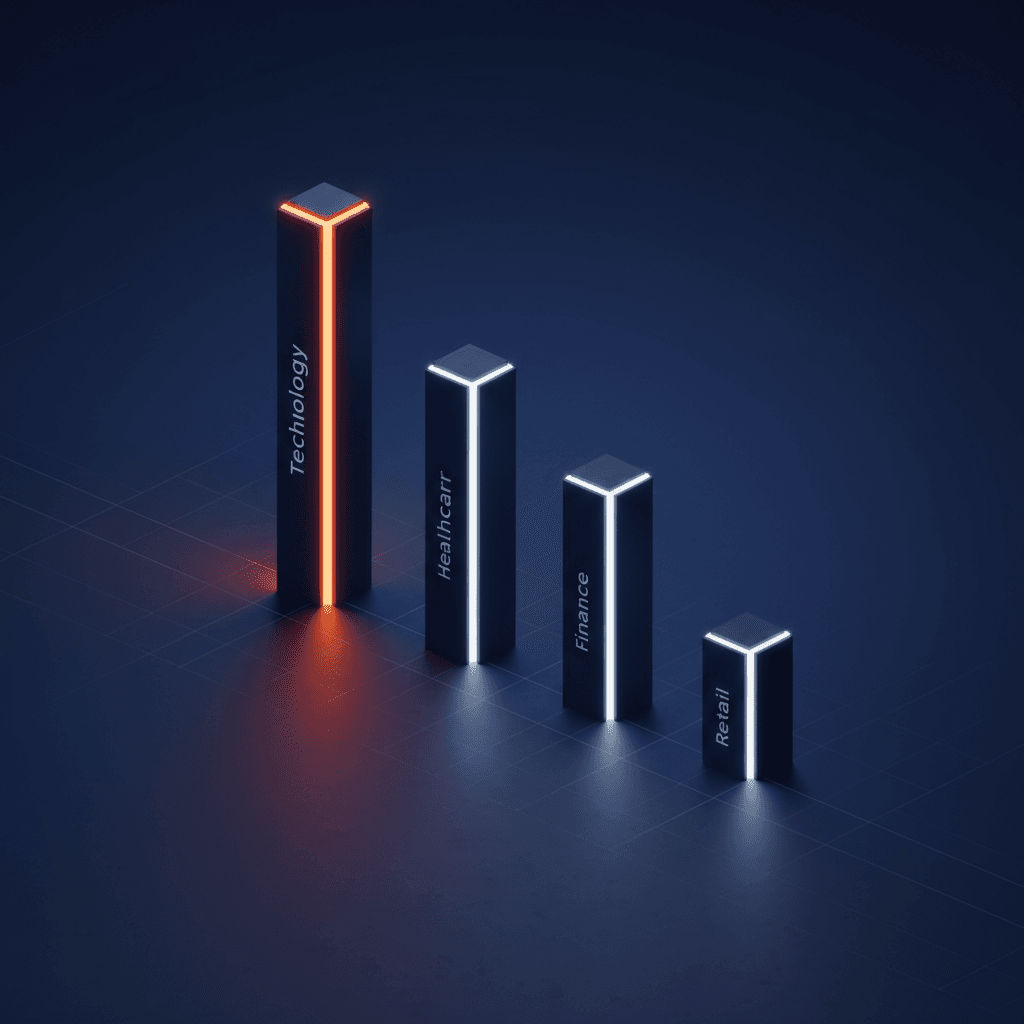

Between 2020 and 2025, AI-driven analytics adoption accelerated fastest in Technology, rising from 50 to 650 tracked units. Healthcare, Finance, and Retail also saw rapid growth, with Healthcare reaching 340 units by 2025. The trend is sectorally uneven but universally steep.

Introduction [why it matters]

By 2025, AI is no longer experimental in data analytics. It has become structural, especially in the Technology sector. Adoption rates are not abstract: the Technology sector increased analytic AI integration by 1,200% between 2020 and 2025. Healthcare, Finance, and Retail have also crossed critical thresholds. These shifts are visible in the data, not just in corporate rhetoric.

Unlike previous digital waves, this one moves in measured increments, not leaps. The data show stepwise but compounding increases, with each sector following a distinct trajectory. The landscape is not uniform. Technology leads, but other sectors are closing the gap at variable rates. The stakes are operational and strategic, not simply technological.

The numbers reflect more than enthusiasm. They signal a phase transition: AI in data analytics now drives sectoral priorities, resource allocation, and competitive advantage.

Understanding the Context [evidence, boundaries]

The available evidence covers four sectors: Technology, Healthcare, Finance, and Retail. Units represent tracked instances of AI-driven data analytics deployments, measured semiannually from January 2020 to January 2025. The data show relative, not absolute, adoption.

Technology begins the period ahead and accelerates most rapidly, reaching 650 units by 2025, compared to Healthcare’s 340, Finance’s 305, and Retail’s 228. The intervals are regular, but the increments widen over time, especially after 2022. Healthcare and Finance move in parallel until late 2023, after which Healthcare outpaces Finance.

The counts do not capture deployment depth or qualitative impact. Sectors may define deployments differently. No visibility into small-scale pilots or failed implementations.

Methodology & Sources [scope, reliability]

- Primary source: PlotSet Analytics sectoral tracking, based on vendor disclosures, procurement filings, and validated deployments

- Data cover January 2020-January 2025, biannual frequency, standardized for scale

- Limitations: Possible underreporting in early years; sectoral definitions may shift; no granularity below sector level

Figure 1: Editorial visual of AI-driven data analytics adoption by sector, highlighting Technology’s dominant lead in 2025.

Figure 2: Race bar chart animation highlighting the most consequential shift in the series

Key Insights & Analysis [trend shifts, sector gaps]

Technology Sector Acceleration [technology lead, compounding]

Technology’s adoption curve is exponential rather than linear. Between 2020 and 2022, the sector’s tracked deployments increase from 50 to 145. The next three years see steeper gains, culminating in 650 units by 2025. The Technology sector ends the period with nearly double the combined growth of the other three sectors. This is not a cyclical effect. It signals a compound advantage.

Technology’s lead is not marginal. By mid-2023, it crosses the 320 mark, outpacing Healthcare by over 90 units.

Healthcare’s Inflection [healthcare, overtakes finance]

Healthcare begins with slow growth but gains momentum after 2022. The sector moves from 30 to 340 units in five years, a more than 1,000% absolute increase. Notably, Healthcare overtakes Finance between 2023 and 2025, reflecting regulatory shifts, pandemic-driven urgency, and increased data availability. The divergence occurs after a period of parallel growth.

Healthcare’s trajectory is shaped by external shocks as much as internal readiness.

Finance & Retail: Steady but Subordinate [finance retail, gap widens]

Finance and Retail follow steadier, less volatile paths. Finance grows from 25 to 305 units, Retail from 15 to 228. Both accelerate after 2022, but the gap with Technology and Healthcare widens. Retail’s curve is the shallowest but still registers a 1,420% gain over the five-year period.

Sectoral lag is evident, but absolute numbers conceal qualitative differences.

Closing Thought [open end, structural ambiguity]

The structural lead held by Technology in AI-driven analytics is real, but the sectoral gaps are neither fixed nor immune to reversal. What the numbers do not show is where the next inflection will emerge, or which external shock will redraw these trajectories.